BAMS Is Trusted By 1000s Of Merchants

Save Money with Competitive Merchant Services Fees

Transaction fees can add up quickly and eat away at profits, which is why BAMS offers our merchants competitive and customized pricing. As a BAMS merchant, you’ll save money on each and every transaction you process, thanks to our interchange-plus pricing model.

The interchange-plus model dynamically adjusts your pricing every time a card is processed to ensure that the fee you pay is as low as possible based on the actual base rates charged by the major card companies. Rather than paying a flat fee that overcharges you on certain cards and transactions, you’ll get the best rate possible each and every time.

Over the course of a year, the savings on those fees can add up to thousands of dollars, and over the lifespan of your business, it adds up to a lot more!

Get More from Your Merchant Services with

BAMS Value-Added Features

Merchant services are about more than just processing payments, and as a BAMS merchant, you’ll get access to some of the industry’s best add-on features to help you with everything from getting your money faster, to fighting transaction disputes, to understanding your business better, and more.

Next-Day Funding

Cash flow is the key to your company’s financial health, and accessing the funds from your sales faster ensures you’ll always have the liquid cash you need to meet short-term expenses and face emergencies head-on.

Our next-day funding program enables qualifying merchants to gain access to funds as little as ten hours after transactions are batched, at no extra cost.

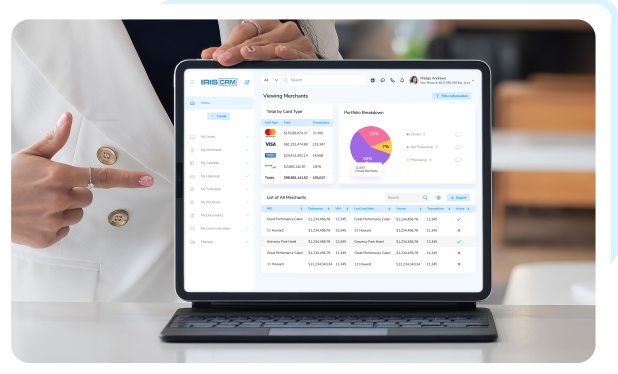

Advanced Reporting

Knowledge is power,

and the more you know

about your company’s sales operations, the better you can plan for short and long-term goals and future growth.

BAMS merchants get free access to an advanced merchant reporting dashboard that provides in-depth yet easily usable analytics on all the most important key performance indicators.

Chargeback Defense

Chargebacks cost your business money and have the potential to damage your relationship

with the card companies. And while disputes are inevitable,

losing them is not.

BAMS Dispute Responder is a tool designed to make fighting chargebacks faster and easier than ever through immediate notification, a clear action plan, and easy online management.

Let BAMS Lay Out Your Potential Savings

Line-by-Line with

Our Five-Point Price Comparison

Let BAMS Lay Out Your Potential Savings

Line-by-Line with

Our Five-Point Price Comparison

Don’t just trust us when we say you’ll save money thanks to our industry-best pricing; see for yourself! When you submit a request for a free, in-depth Five-Point Price Comparison, a member of the BAMS team will scour through your existing merchant statements, line-by-line, to identify everywhere we can save you money while delivering you the payment processing services you need. Merchant statements are complex and often confusing documents, but with our Five-Point Price Comparison, we remove the complexity and make it simple and easy to understand how much you’re currently paying, where the money is going, and how we can eliminate overcharges and waste!

Give Your Customers the Option to Pay

How and Where They Want

Customers today demand two things from all merchants – convenience and choice. Your ability to offer them both has a huge impact on the quality of their experience and, in turn, their loyalty and lifetime value. As a BAMS merchant, you can easily provide your customers with the payment options they want across all key channels, including in-store, online, and mobile payments.

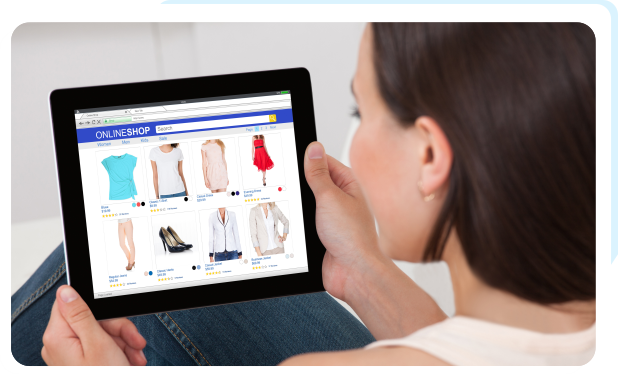

eCommerce Payments

BAMS ecommerce merchant accounts integrate seamlessly with all the top payment gateways and ecommerce systems.

For established businesses making the switch to BAMS, you’ll be able to keep using your existing systems with zero interruption. For new merchants just getting started, you’ll be able to access the systems you need without having

to compromise.

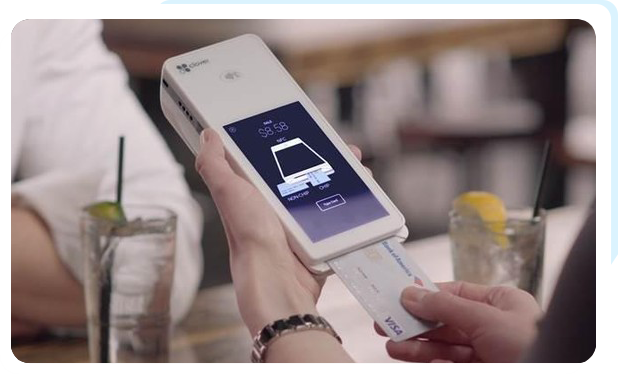

Payment Hardware

Tap, insert, or swipe? Every customer has a preference, and enabling them to use all the features of their payment cards is key to a great checkout experience.

As a BAMS merchant, you’ll have access to all the modern EMV payment hardware you need to accept in-store card payments, including the all-important tap payments that now dominate in a post-pandemic world.

Mobile Payments

Mobility is a big part of convenience, and mobile systems make electronic payments easier and more flexible than ever.

With BAMS, you can accept mobile payments from anywhere using portable payment terminals and smartphone-based card readers. You can also give your customers the convenience of paying with their phones using top digital wallets like Apple Pay.

Get Started with

No Interruptions and

No Headaches!

Switching to BAMS is an easy, frictionless experience that will ensure you get set up with the payment services you need, with the best possible rates, with no interruptions to your business. When you switch to BAMS, you’ll be assigned a dedicated account manager who will work with you to understand your existing systems and anything you’re looking to change. They’ll create an onboarding plan designed specifically to make every part of your transition to BAMS as smooth and easy as possible for you and your business. Your dedicated account manager also gives you a familiar point of contact each time you reach out to BAMS with questions or support requests.

With BAMS, you’ll always deal with someone who knows your business inside and out. Our commitment to acting as a true partner and building a strong, one-on-one relationship with you is a big part of what sets BAMS apart from other payment processors, and we’re confident you’ll experience the difference from your very first contact with us.

BAMS Testimonials

Working with BAMS and in particular Alex B. has been such a pleasure. Previous credit card processors - it was impossible to get a response from a real person. Even when you interact with the tech team during setup or due to a change in IT on our end, our main point person is still made aware of those interactions with the other BAMS team members so everyone remains on the same page. We even get daily notifications of our charges and when the funds hit our account. All at a great low rate too!

At first I felt pretty reluctant to switch to BAMS because it is related to credit cards and there were a lot of scams related to these kinds of services with extremely high fee. However, BAMS and especially Olga worked very hard to gain my trust and support with the transitions. It took a few weeks of back and forth to get everything resolved, but in the end the saving is totally worth it.

We have been through a few merchant service providers. BAMS is one of the best we have encountered thus far, with regards to customer service and low fees! Their processing fees are very good: no monthly contracts, low batch fees, statement fees, etc. Next-day funding has been especially helpful as well. I like not having to wait for my money to come through!

Chargeback Defense

- Day-zero notifications of all new disputes with automatic reminders on day one and day three.

- Easy-to-follow action checklists based on each dispute’s reason code.

- Manage the entire dispute process online without the need to handle, scan, or send paper documents.

- Monitor ongoing and previous disputes to help prevent future disputes.

Next-Day Funding

- Access funds in as little as ten hours at no extra charge!

- Funds batched by cutoff arrive by 7 AM EST the next business day.

- Enjoy a 9 PM EST cutoff time – one of the latest in the industry.

- Funds batched after cutoff arrive by 7 AM EST one business day later.

Ecommerce Payment Solutions

- Integrate BAMS in minutes with all of the industry’s top online payment gateways, including Authorize.Net, USAePay, NMI, and more.

- Utilize top ecommerce systems like Magneto, BigCommerce, WooCommerce, and more.

- Access all of BAMS leading value-added features while giving your customers the fast, easy online payments they demand.

- Benefit from our partnerships with some of the industry’s leading fraud prevention companies like Signifyd.

EMV Payment Terminals

- Offer customers the ability to safely and securely pay with chip and contactless payment cards.

- Ensure your business is up-to-date with all regulatory requirements for payment hardware security.

- Minimize liability and access better rates by using the most secure card-present payment options available.

- Choose the hardware that best suits your business, from single payment terminals to fully-integrated POS systems.

Mobile Payment Hardware

- Access the mobile payment hardware you need to take payments from anywhere.

- Utilize wireless mobile payment terminals for curbside pickup, delivery, and more.

- Turn smartphones into payment devices with swipe and EMV-compliant mobile card readers.

- Use mobile payment devices in-store to reduce congestion at traditional checkout points.

Digital Wallets

- Let your customers pay with top digital wallets like Apple Pay and Samsung Pay.

- Provide the convenience of in-store and online payments with a single click or phone tap.

- Enjoy the additional security provided by digital wallets’ built-in biometric verifications.

- Get started in seconds with digital wallet-ready EMV payment hardware.

Dedicated Support

- Build a long-term relationship with your own dedicated account manager.

- Never worry about struggling with support that doesn’t understand the intricacies of your business.

- Enjoy one-on-one support from the very beginning of your journey with BAMS and for the lifetime of your payment processing.

- Access your account manager however it suits you, by phone, email, text, or our online support portal.

- Multi-level support including supervisor availability and a 24/7 call center to ensure problems are solved regardless of the time of day.

- Rest assured you’re backed by one of the strongest, most experienced teams in the payments industry.

Recent Posts

The 5 BigCommerce Apps Your Store Needs Today

Feeling the pinch of competition? Desiring to elevate your sales? Ecommerce retargeting is the silver bullet you're looking for. This robust marketing approach leverages technology to cater ads to individuals who've previously engaged with your…

Read moreThe 5 BigCommerce Apps Your Store Needs Today

5 ways to automate WordPress with Zapier to grow your business

As a leading merchant services provider, we aim to help businesses run more efficiently, both financially and logistically. Crafting blog posts, managing social media promotions, and maintaining content archives can be overwhelming. That's where automation…

Read more5 ways to automate WordPress with Zapier to grow your business

What Is Magento or Adobe Commerce and Why Should You Use It In Your Business?

Magento was one of the oldest players in the ecommerce space, building a reputation as an extremely capable, reliable, and secure sales platform. Today, Magento has been rolled into Adobe Commerce, a one-stop ecommerce solution…

Read moreWhat Is Magento or Adobe Commerce and Why Should You Use It In Your Business?