Buy Now, Pay Later Services For Merchants

Increase your business’s sales, average order value, reduce cart abandonment, and get paid up front — all at no risk to your business — with Buy Now, Pay Later for Merchants.

How Do Buy Now, Pay Later Services Work?

Buy Now, Pay Later Merchant Benefits

-

ADDITIONAL CUSTOMERS

Customers are more likely to get approved for BNPL transactions through Sezzle because they allow customers with low or no credit to be approved. Based on an internal survey of 8,700 respondents, 52% reported being declined by other BNPLs2.

-

ABANDONED CARTS DECREASE

Not only are transactions made through Sezzle approved more often than other payment services, but 40% of BNPL users abandon carts if Sezzle is not an option3.

-

AVOID COST OF FRAUD CHECKS

Sezzle runs fraud checks on their end, saving merchants from the hassle of expensive third-party checks.

-

REDUCE RISK OF NON-PAYMENT

Sezzle pays merchants the full order of the cost up front, absorbing the risk of any non-payment and allowing businesses even more control over their inventory.

-

IMPROVED CUSTOMER EXPERIENCE

Sezzle’s Buy Now, Pay Later services offer a faster, more convenient way to access financing.

Frequently Asked Questions

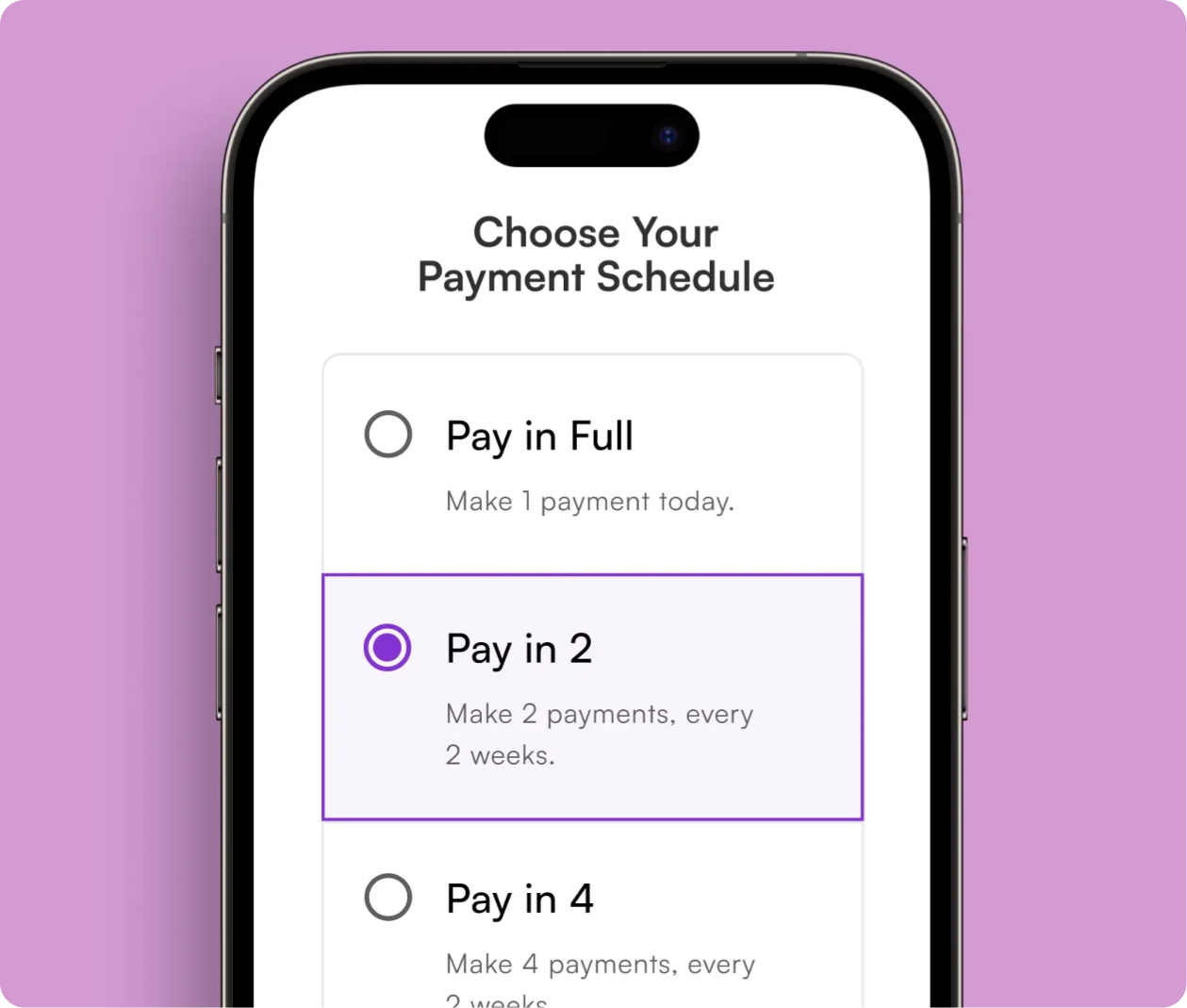

Buy Now, Pay Later (BNPL) is a flexible payment option that lets customers split their purchase into smaller, interest-free installments instead of paying in full at checkout. With Sezzle, shoppers have several purchase options to spread out their payments. This helps them budget better without having to compromise on their interests, and while your business gets paid in full right away!

Your revenue is protected. Sezzle pays your business upfront for every order, regardless of whether customers complete their installments. If a shopper misses a payment, Sezzle handles the collections process — not you. That means you increase sales without taking on any risk.

Most businesses that sell consumer goods and services are eligible. Whether you run an online store, a brick-and-mortar shop, or both, Sezzle can integrate with your sales channels. Approval is quick, and you’ll know right away if your business qualifies. Our goal is to get you up and running before you miss even one potential customer.

Getting started is easy. You’ll simply apply online, and once approved, you can begin offering BNPL at checkout. The process only takes a few minutes, and our team is here to support you every step of the way.

Sezzle integrates seamlessly with popular e-commerce platforms like Shopify, WooCommerce, BigCommerce, and more. With just a few clicks, you can enable Sezzle as a checkout option — no complicated coding required. Your customers will see Sezzle at checkout and can start using it immediately.