What Are Pre Arbitration Fees and How Are They Assessed?

Merchants need to have a strong handle on their business, especially with regards to how the business is growing and any risks to that growth. One potential risk comes from arbitration fees, which are assessed when the chargeback process is taken to the arbitration stage and ruled in favor of the cardholder.

Visa, Mastercard, American Express, and Discover are all in the process of improving their chargeback processes to become more efficient, to reduce the overall volume of chargebacks on their cards, and to eliminate invalid chargebacks. Improved processes do come at a cost, however, and Visa and Mastercard have recently started to assess arbitration fees due to the improvements they are making to the chargeback process. American Express and Discover are expected to announce their own arbitration fees in the near future.

New Visa and Mastercard Pre Arbitration Fees

Visa now charges a $500.00 Case Filing Review fee for any cases that reach the arbitration stage and are ruled in favor of the cardholder. Visa can also charge a $250.00 Visa Technical Penalty fee, but only if they find that the business has violated Visa’s rules.

Mastercard charges a $400.00 arbitration fee and does not currently assess any extra penalties beyond the $400.00.

Your business is potentially liable for these arbitration fees, but there are ways to avoid them. Read on to learn how you can avoid unnecessary arbitration fees and the best practices for managing chargebacks and disputes.

How to Avoid Arbitration Fees

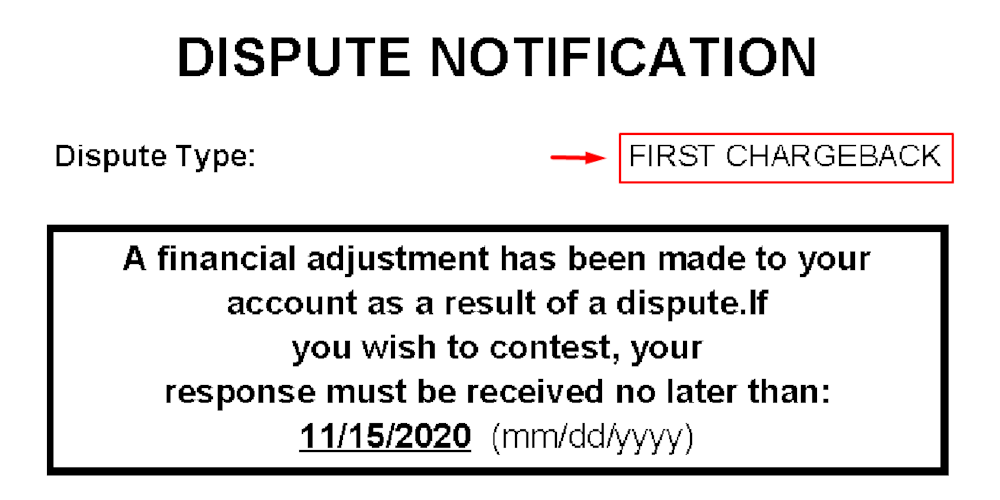

Arbitration fees are closely related to chargebacks, which occur when a customer disputes a credit card charge from your business. You, as the merchant, can accept the chargeback from the customer or you can dispute it. If you choose to dispute the charge, you can provide information and/or evidence to prove that you fulfilled your end of the transaction. Here is what an initial alert for a chargeback can look like:

The chargeback can then be accepted, which means the dispute was ruled in the cardholder’s favor. The disputed charge amount will be returned to the cardholder, as the decision was made that you did not fulfill your side of the transaction based on the information and evidence provided.

Alternatively, the ruling can be in your favor as the merchant. In this case, the funds in dispute are returned to your business – but the process does not end there. If the ruling is in favor of your business, the cardholder or their card issuer can re-open the dispute and elevate it to arbitration. Arbitration means that the chargeback dispute has been elevated beyond the banks to the card brand itself.

The Cost of Pre Arbitration

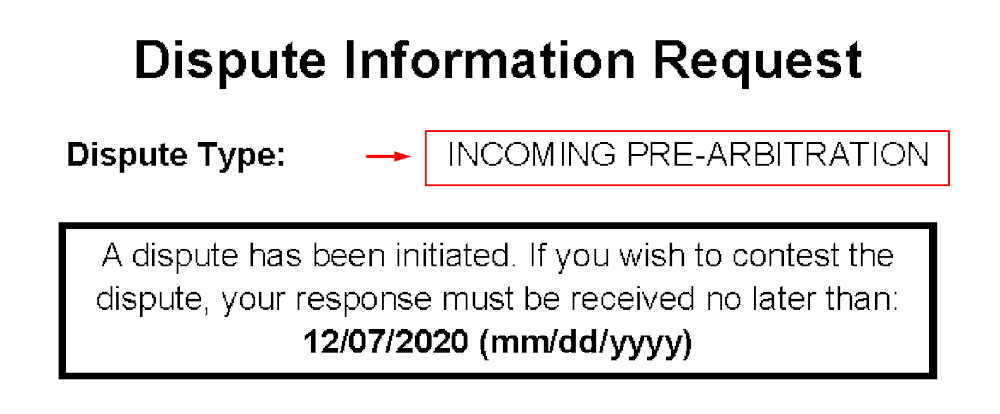

When a dispute is elevated to pre arbitration, the merchant will receive another alert letting them know that the dispute, which had previously been ruled in their favor, has been reopened. At this stage of pre-arbitration or second chargeback, the business can once again respond to the dispute. The merchant’s response will be forwarded directly to the card brand.

By responding to the pre-arbitration request, a merchant is starting the arbitration process and can be held liable for arbitration fees.

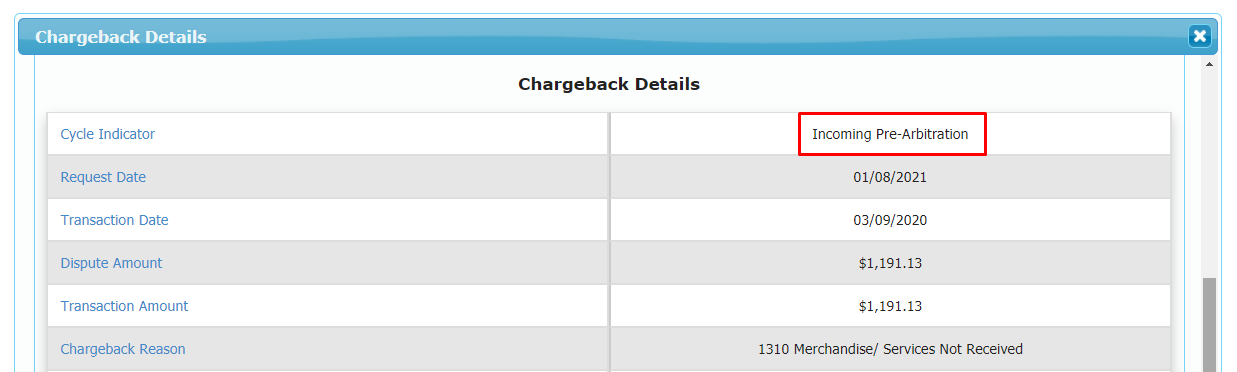

Here’s an example of a pre-arbitration alert/information request:

NOTE: In this notification, the ‘Dispute Type’ is defined as pre-arbitration which means that responding to this dispute will make you potentially liable for Visa/Mastercard’s arbitration fees.

If the dispute is resolved in the cardholder’s favor during arbitration, the merchant can be liable for arbitration fees. Regardless of how the dispute was originally ruled, simply responding to the elevated dispute can become costly for merchants.

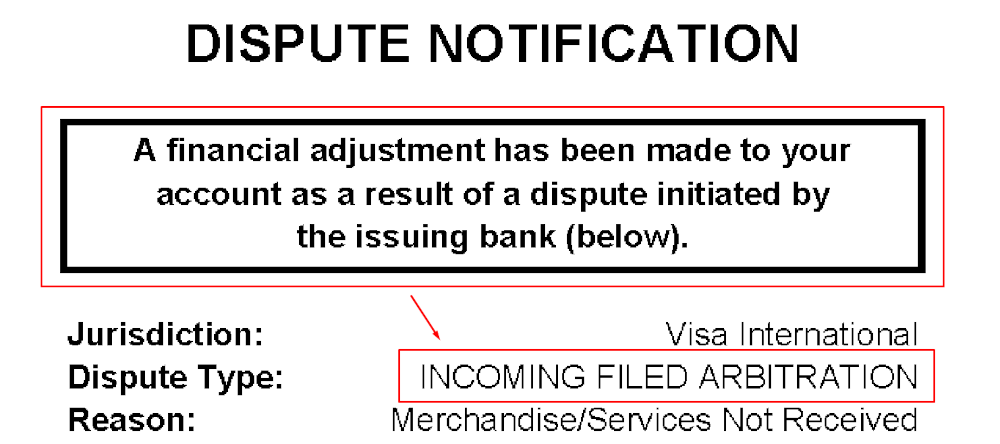

Depending on the card brand and the size of the transaction, it can actually make more financial sense to accept the disputed charge at this stage rather than face the steep arbitration fees assessed if the dispute is ruled in favor of the cardholder at this stage. A merchant could receive the following alert if the arbitration is ruled in favor of the cardholder:

Many arbitration cases are for small dollar amounts, which means that you need to consider the card brand, their fees, and the total amount that your business would receive if you win the arbitration. If the amount that you would receive upon winning is low, you could be taking on the risk of significant arbitration fees for relatively little reward.

Key Takeaways

For Small Transactions Payment Gateways

While Discover and American Express do not currently charge arbitration fees, there is anticipation that the announcement will be coming. In any case, merchants need to be aware of the cost of arbitration for Visa and Mastercard cardholders – particularly in the case of disputed transactions for small amounts.

If the transaction is for a small amount and you receive a notice that a chargeback ruling, which was previously ruled in your favor, has been disputed, make sure that it is worth taking on the risk of these costly arbitration fees before you choose to respond.

Alternatives to Pre Arbitration

If possible, try to contact the customer directly to resolve the dispute and you can potentially avoid the arbitration process altogether. For larger disputes, sometimes it can make financial sense to avoid the card brand’s arbitration process and pursue legal action within the court system itself. While we are not recommending any action when facing a reopened dispute, we are providing this information so you can make the best decisions for your business.

In the future, keep an eye out for news regarding new or increased arbitration fees from major card brands. These updates will typically come on your month-end billing statement, so make sure you are reviewing your statements each month with a close eye.

BAMS Dispute Manager Assistant

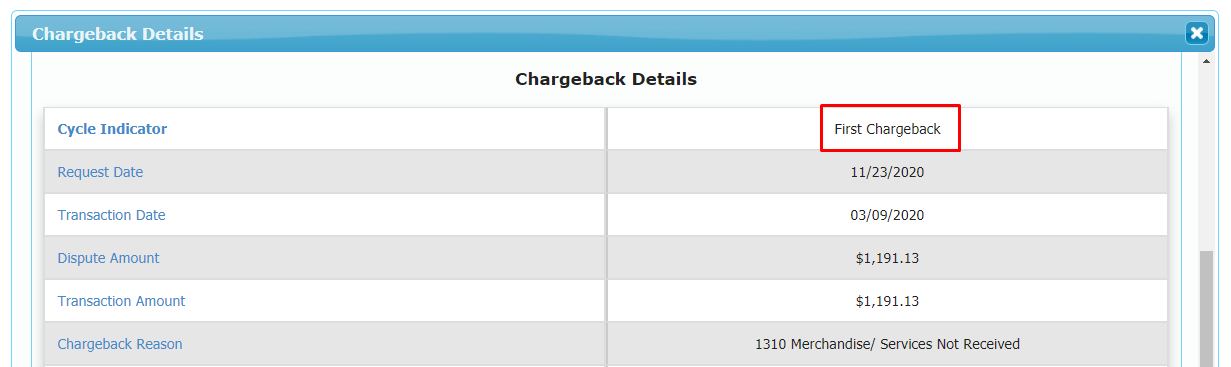

BAMS is also here to help with BAMS Dispute Manager Assistant, which is automatically included for all BAMS merchants. BAMS Dispute Manager Assistant helps merchants win more chargebacks with key features including instant dispute notifications, exportable reason code data, document uploads, and notifications of status changes throughout the dispute process.

Here is an example of what an initial chargeback notification looks like in BAMS Dispute Manager Assistant:

Below is an example of a pre-arbitration/second dispute notification looks like in BAMS Dispute Manager Assistant:

BAMS Dispute Manager Assistant empowers you to take control of the dispute process and ensure that your business is in the best position to respond to and deal with chargebacks.

The Dispute Manager Assistant is available for most processing platforms with some exceptions. To confirm availability and schedule a training session please reach out to support@bams.com or call 866-510-2267, option 2.