Feeling the pinch of competition? Desiring to elevate your sales? Ecommerce retargeting is the silver bullet you’re looking for. This robust marketing approach leverages technology to cater ads to individuals who’ve previously engaged with your brand online or visited your ecommerce store. By embracing this strategy, you will replace one-size-fits-all ads with personalized product suggestions […]

Tag: BAMS

Next day funding is a credit card processing feature that sees the funds from a merchant’s sales hit their bank account in a single business day. If you’re currently taking credit card payments, you’re probably used to waiting at least two business days to access your funds. Next day funding eliminates that wait. It shortens […]

Fast access to cash is crucial for all types of businesses, and the smaller the business, the more important it is. But the traditional funding process often sees merchants wait three business days, or occasionally even more, before getting access to the money from their sales. Next day funding offers a solution to that problem […]

Chargebacks are an unfortunate reality of doing business, and sometimes customers are fully within reason to file one. But, what happens when chargebacks are abused? Unfortunately, the dispute process is heavily weighted towards the customer, and far too many merchants have fallen victim to lost revenue from fraudulent chargebacks. But, like all types of fraud, […]

Apple Cash is a new digital payment product designed to make it even easier for Apple device users to send, receive, and manage their money. It works in conjunction with Apple Pay and the Messages App, providing users with a complete, one-stop payment solution. Apple Cash creates a virtual debit card in the user’s digital […]

Toast POS is one of the most popular point-of-sale systems in the restaurant industry. It’s known for feature-rich and easy-to-use software and a wide variety of hardware options. But while Toast POS is both highly capable and user-friendly, it does have some notable drawbacks, including the cost of payment processing and dependence on proprietary hardware. […]

Choosing a new payment processor is an important task, as payments are at the core of all businesses. But with so many options on the market, it can be hard for merchants to know how to differentiate one processor from another. When requesting a merchant services quote, many business owners will focus on price and […]

Having a payment gateway that accepts credit cards on-site is important for most modern businesses, and it’s an absolute must for retail businesses, where cash-only sales are all but extinct. But how do you go about getting a credit card reader? The good news is that getting set up with a reader isn’t that hard, […]

Next day funding is a payment processing feature that allows merchants to get their payouts in a single business day, without the need to wait on standard holds. It’s one of the most important features merchants can weigh when selecting the right payment processing partner. Not all merchant services companies offer next day funding, and […]

Retail ecommerce is already worth over 431 billion dollars in the United States alone and is set to exceed $563 billion by 2025. Simply put, your customers are already online. If you’re still weighing the pros and cons of selling on the web, now is the time to take the plunge. Expanding your sales to […]

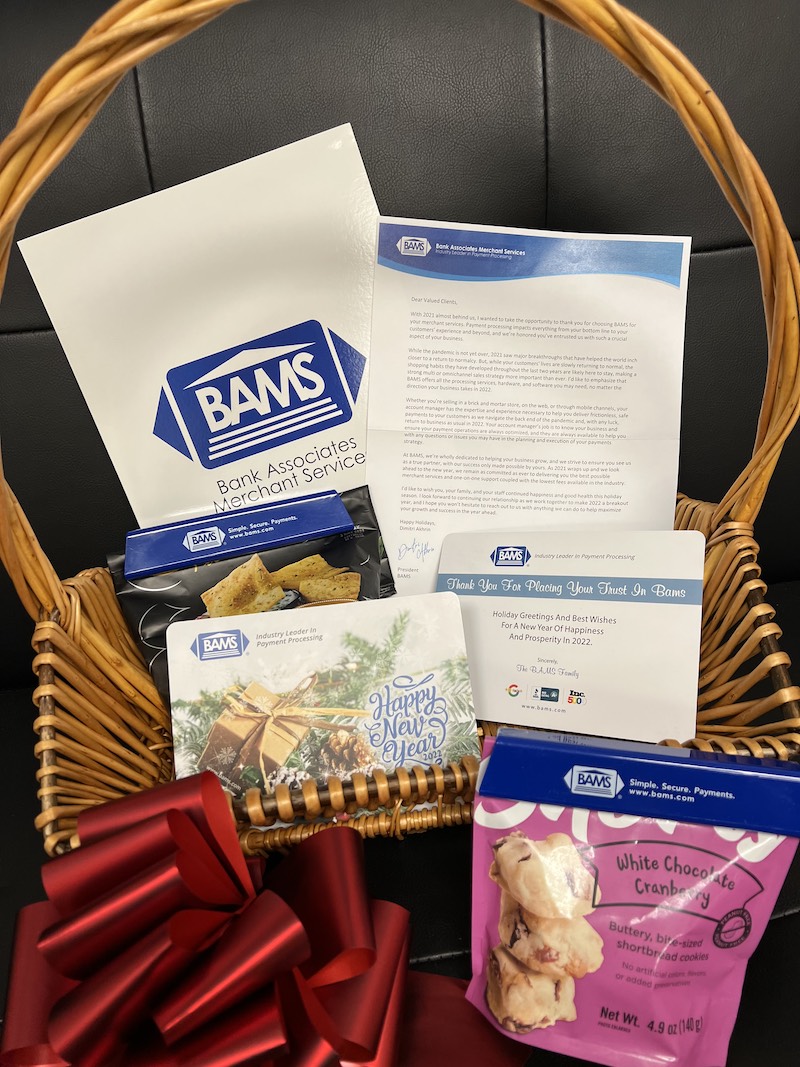

Dear Valued Clients, With 2021 almost behind us, I wanted to take the opportunity to thank you for choosing BAMS for your merchant services. Payment processing impacts everything from your bottom line to your customers’ experience and beyond, and we’re honored you’ve entrusted us with such a crucial aspect of your business.

Apple Pay and other digital wallets, like Google Pay and Samsung Pay, are mobile payment technologies that allow users to pay for things with a simple tap of their phone or the click of a single button online. They offer speed, convenience, and, thanks to built-in biometric ID, heightened security. It comes as no surprise […]

When many people hear the term merchant services, they automatically think “transaction processing.” And, while that is a huge part of what payment processors do and certainly worth discussing, it isn’t the only thing processors offer businesses. Many merchant services providers today actually offer their clients end-to-end payment solutions that allow merchants to get everything […]

Fees matter. In the earliest days of your business, when you were doing low sales volume, and your top priority was just getting to the customer any way you could, you may have put transaction fees low on your list of priorities. After all, what’s a percent here or ten or twenty cents there? But […]

Chargebacks are the bane of merchants, independent sales organizations (ISOs), and payment processors alike because they have the potential to cost everyone involved in payment processing a significant amount of money and headache. Chargeback defense programs are services offered by ISOs, processors, and third parties designed to catch and defeat chargebacks before they have the […]

Payment processing is at the heart of every swipe, tap, or entry of a credit or debit payment, making it a crucial service that all merchants depend on. If you’re like most merchants, low fees and value-added services might be the first thing that comes to mind when evaluating potential processing partners, but there’s a […]

Your ecommerce merchant services provider is one of the easiest factors to overlook when it comes to the success or failure of your ecommerce business. It can be easy to assume that all merchant services providers are the same, but that couldn’t be further from the truth. The processing partner you choose will impact everything […]

Next day funding is a feature offered by some payment processors that sees the funds from a merchant’s batched transactions hit their account in as little as a single business day, with no standard hold applied. Processors set a cutoff time, and the funds from any transaction batched before that time will be available in […]

Every business looking to make credit or debit card sales will eventually have to engage with some type of payment processor, also sometimes known as a merchant services provider. These companies offer a number of products and services designed to facilitate secure, convenient card transactions, but they also offer a wide variety of value-added services […]